If the Finance and Utility Commissions are asked to thoroughly consider the pros and cons of FPL’s latest offer, one question that will surely be asked is whether a deal in which the city nets nearly nothing and rate payers are required to kick in $26 million is fair to anyone, must less a win-win for everyone. Mayor Richard Winger, who ran on a platform of negotiating a fair price, joined fellow Council member Jay Kramer in declining to sign the purchase and sale contract approved last spring by Tracy Carroll, Craig Fletcher and Pilar Turner. One of Winger’s numerous concerns about the contract was the three-year closing window, which allows for a closing as late as December 31, 2016. If left unchanged, the current contract could leave the City and its electric customers in limbo three more years.

NEWS ANALYSIS

Florida Power & Light President Eric Silagy: “Sometimes the best deal is the one you walk away from.”

MARK SCHUMANN

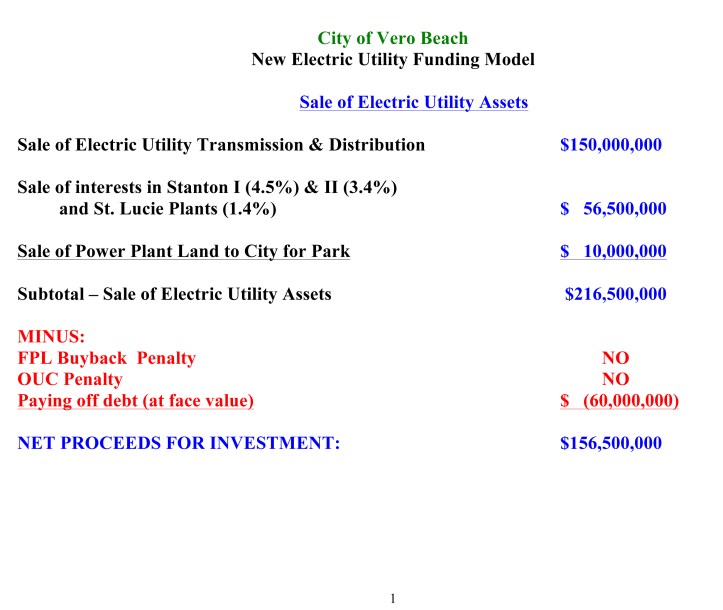

When Vero Beach voters were first persuaded of the benefits of selling their electric system to Florida Power & Light, influential and persuasive utility activists were claiming the city would net $156.5 million from the sale. The public was also assured there would be no loss of city services and no need to increases taxes. As it is turning out, the city will gain virtually nothing from the sale. Municipal services are already being trimmed and the customers of Vero Electric are being asked to pay $26 million to help fund the deal.

The story of the proposed sale of Vero Electric to FPL is one of a deal gone bad. Many characters play important roles, but perhaps none are more central to the story than utility activists Glenn Heran and Dr. Stephen Faherty.

On October 29, 2009, Faherty wrote then City Council candidate Ken Daige, “Ken, Attached is a summary of what Glenn’s financial model can do. It shows no City tax increase, a possible tax decrease, and $625 in each customer’s pocket. Also attached are legislative proposals. Good Luck. Glenn and I look forward to working with you.”

Faherty’s email to Daige is just one of many examples of how he and Heran worked to build support for the sale. They made presentations to the City Council, the County Commission and to any group that would listen to their plan for getting the city out of the electric utility business.

The Heran-Faherty proposal was simple and compelling. Vero Beach, which at the time had among the highest power rates in Florida, would sell to Florida Power & Light, which at the time had the lowest rates in the state. (As of January, 2014, FPL is no longer the lowest cost power provider in Florida.)

Heran and Faherty presented what seemed like well-considered and credible reasons for selling Vero Electric. The city, they said, would net $156.5 million on the sale. Investment earnings from the sale proceeds could be used to offset the $5 million plus transferred annually from the electric fund to the general fund to help pay for municipal services, such as police protection, park maintenance and recreation. Taxes would not have to be raised. Services would not be cut, and the 34,000 customers of Vero Electric would begin enjoying the lowest electric rates in the state.

Though taxes have not yet been raised, city services have already been cut in anticipation of the sale. Why? Because the $156.5 million Heran and Faherty projected the city would net from the sale has all but evaporated. Current estimates are that the city will be left with no more than $2 million to $3 million. Long gone is any discussion of how best to invest $156.5 million in sale proceeds.

Not only will the city have to move forward with little or no proceeds from the sale, the latest news is that the City Council is being asked by FPL to approve a $26 million surcharge to be assessed the customers of Vero Electric. This surcharge “tax” is to be paid over several years.

Heran’s and Faherty’s projected $156.5 million is now down to a net negative $26 million – a difference of $182.5 million. How could the respected PhD and his accounting friend have been so wrong?

To be sure, Heran and Faherty were not alone in leading the people of Vero Beach down a road that had turned out to be, not a primrose path, but a trail of disappointment and frustration, if not tears. In the fall of 2009, then city council candidate Charlie Wilson stated emphatically and unequivocally that the city would net $90 million, after paying off $60 million in utility system debt.

The first mistake Heran, Faherty and Wilson made was to assume the city’s position in three Florida Municipal Power Agency projects had a positive value. Some people, who Wilson and other advocates of the sale called “naysayers,” counseled caution and questioned what they believed to be unrealistically optimistic assumptions.

In the face of these challenges, Heran, Faherty and Wilson, along with other advocates of the sale, including Tracy Carroll, Craig Fletcher and Pilar Turner, ignored information that did not fit their preconceived ideas about how the deal should work. When, for example, several members the Finance Commission and Utilities Commission remained stubbornly pessimistic about the sale, Carroll, Fletcher and Turner simply replaced them with more compliant commissioners.

As an example of how overly optimistic the pro-sale assumptions were, Heran once claimed Vero Beach should be able to leave the FMPA with a “share” of the agency’s cash on hand. The kindest thing that can be said about Heran’s idea is that he was wrong.

Here is yet another monumental miscalculation: Rather than selling its position in the Stanton I, Stanton II and Saint Lucie Two nuclear plants for $56.5 million, the city will have to pay the Orlando Utilities Commission $34 million in cash to assume these power entitlements. As further compensation, the OUC will receive Vero Beach’s gas transmission rights, which have been valued at $8 million to $10 million.

Yet another miscalculation made by Heran, Faherty and Wilson was their assumption that the city could simply walk away from its 20-year wholesale power contract with the OUC. If the sale goes forward, the city will pay the OUC $20 million in liquidated damages to terminate a 20-year wholesale power agreement that went into effect in 2010.

From a positive number of $56 million to a negative of $54 million, these two miscalculations alone have thrown the deal off by $110 million.

Heran, Faherty and Wilson also assumed FPL would pay more in cash for the system. In truth, a significant portion of the value FPL has placed on its offer for Vero Electric is in the cost of dismantling the power plant, building a new substation and upgrading transmission and distribution lines.

Now we come to the $52 million to be paid to the FMPA to take on Vero Beach’s power from the Stanton I and Stanton II plants through January 1, 2018, at which point the OUC will be on the hook.

Local critics of the FMPA, and even FPL President Eric Silagy, have tried to characterize the agency’s $52 million offer as unrealistic. They do not bother to point out that the OUC also made an offer, a deal which FPL did not accept.

Whether the FMPA offer of $52 million is realistic is a question that can be debated endlessly by people who do not have the facts, but the truth is the FMPA’s offer was at least in some way more attractive to FPL than the one made by the OUC.

FPL is willing to pay only half of this $52 million. From where will the remaining $26 million come? FPL’s proposal is to pass the cost on to the city’s 34,000 electric customers in the form of a surcharge, which must be approved by the Vero Beach City Council, by Vero Beach voters in a referendum to be held, most likely, in August or November, and ultimately by the Florida Public Service Commission.

Clearly the voters of Vero Beach have two, and only two choices. They can either approve FPL’s request to have the customers of Vero Electric pay $26 million of the cost of selling the system, or they can conclude that after years of expensive and often unproductive negotiations it is time to look at other options, including a partial sale, the formation of a utility commission, renegotiating the city’s wholesale power contract with the OUC, decommissioning the power plant and looking for other ways to run the system more efficiently, as well as reducing the amount of the annual transfer to the general fund.

It seems likely that before the Council will act on FPL’s latest proposal, the Finance Commission and the Utilities Commission will first vet the offer. If these commissions are asked to thoroughly consider the pros and cons, one question that will surely be asked is where a deal in which the city nets nearly nothing and rate payers are required to kick in $26 million is fair to anyone, must less a win-win for everyone.

Assuming the Council eventually acts on the recommendations of the Finance Commission and the Utilities Commission, Mayor Richard Winger may well prove the deciding vote. Like fellow council members Jay Kramer and Amelia Graves, Winger is well aware of ways the city could lower electric rates. Anyone in Winger’s position, though, might wonder what council he will be working with after the November election.

Together, Kramer, Graves and Winger could be expected to make practical decisions about running the electric system more efficiently, possibly even forming a utility authority to address the issue of representation for out-of-city customers. But what if Kramer departs from the Council and is replaced with the likes of Charlie Wilson, Dan Stump, or Brian Heady? At that point, all bets would be off on whether the Council could be any more effective than Congress in accomplishing the work of the people.

Two things seem clear. First, the deal to sell the city’s electric system to FPL is nothing like what was presented to the public in 2008 and 2009. Second, the people of Vero Beach have only begun to witness the length to which FPL can and will flex its considerable financial and political muscle. Between now and any eventual referendum, the question of whether the deal is fair will be drowned in a tsunami of political advertising and backroom arm twisting.

Quoting FPL President Eric Silagy, Scripps columnist Michael Goforth wrote, “Sometimes, he said, the best deal is the one you walk away from.”

Perhaps Silagy is more right than he could possibly imagine.

In the “follow the money” review of the electric utility, I am reminded of the infamous quote from the late Senator Dirkesen who was alleged to have said: “A billion here, a billion there — the next thing that you are talking about his real money.”

Better to change course than fly into the storm…….Fools rush in where wise men never go…..Turn off the TV and lights when you leave the room. Don’t believe everyone who tries to sell you something.