MARK SCHUMANN

Email correspondence between the city’s transactional attorney, John Igoe, and FPL attorney, Patrick Bryan, seems to contradict a number of statements Byan and FPL External Affairs manager Amy Brunjes made before the City Council and the County Commission. The email records were obtained yesterday by InsideVero in response to a public records request.

Addressing the Vero Beach City Council March 3, Bryan said FPL never accepted the Florida Municipal Power Agency’s position that a plan for selling Vero Beach’s power to FPL by channeling it through the Orlando Utilities Commission would need to be cleared by the IRS. Just one week later, Bryan’s FPL colleague, Amy Brunjes, went before the Indian River County Board of County Commissioners claiming that any letter to the IRS would be controlled by the Florida Municipal Power Agency.

Speaking before the County Commission March 10, Brunjes said FPL is not confident of closing the deal under the terms of the contract approved by voters last March, ”because of the FMPA’s insistence on that opinion from the IRS.”

Brunjes continued, “We’ve had opinions from our tax counsel, the City’s tax counsel and others that says that those bonds would not be in jeopardy. But as you know, FMPA controls the message, and so we are sort of at their mercy here.”

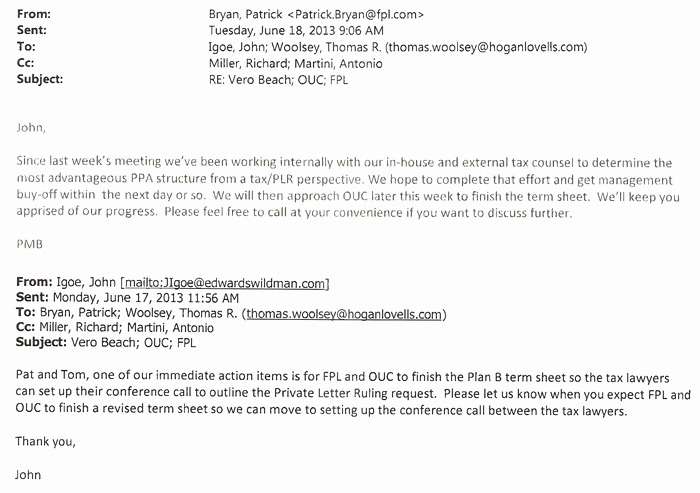

On June 17, 2013, Igoe sent an email to Bryan that confirms representatives of the City, FPL and the OUC were collaborating in preparation for the drafting of a request to the Internal Revenue Service for a private letter ruling addressing tax issues raised by the FMPA.

Igoe wrote, “Pat and Tom, one of our immediate actions is for FPL and OUC to finish the Plan B term sheet so the tax lawyers can set up their conference call to outline the Private Letter Ruling request. Please let us know when you expect FPL and OUC to finish a revised term sheet so we can move to setting up the conference call between the tax lawyers.”

The following day, Bryan responded to Igoe, “Since last week’s meeting we’ve been working internally with our in-house and external tax counsel to determine the most advantageous PPA (Power Purchase Agreement) structure from a tax/PLR perspective. We hope to complete that effort and get management buy-off within the next day or so. We will then approach OUC later this week to finish the term sheet. We’ll keep you appraised of our progress. Please feel free to call at your convenience if you want to discuss further.”