NEWS ANALYSIS

“Though numerous concerns are raised, the Auditor General’s report is absent any suggestion the FMPA is insolvent, as some utility activists have claimed, or that the agency’s leaders and staff may be guilty of “pocketing millions,” as State Rep. Mayfield intimated in a letter she sent to newspaper editors across the state. Also absent from the Auditor General’s report is any finding that FMPA leaders are guilty of malfeasance, another accusation made by some of Vero Beach’s more passionate utility activists.”

MARK SCHUMANN

For the past six months, auditors with the State Auditor General’s Office have been combing through financial records and reviewing the operations of the Florida Municipal Power Agency, a 31-member joint action agency from which Vero Beach’s electric utility receives approximately one-third of its power. The audit was ordered last spring by the Florida Legislature.

Today, State Auditor General David Martin released his office’s preliminary and tentative findings and recommendations in a letter addressed to FMPA leaders. The report raises concerns with the FMPA’s past hedging activities, investment policies, personnel and payroll administration, procurement of goods and services, travel policies, and contract provisions for the FMPA’s All Requirements Project, of which Vero Beach is also a member. The FMPA now has 30 days to submit written statements of explanation addressing each of the Auditor General’s preliminary findings.

FMPA Board Chairman, Bill Conrad, mayor of the City of Newberry, released a statement today after receiving the Auditor General’s preliminary report. “On behalf of FMPA’s Board of Directors, we appreciate the Auditor General’s comments. FMPA is constantly looking for ways we can better serve our members. The Auditors’ six-month review process produced 15 recommendations that merit consideration. We thank the Auditor General staff for a very professional and productive audit.”

FMPA General Manager and CEO Nicholas Guarriello also released a statement today. “I would like to thank the Auditor General’s staff for their independent and professional work. In the public arena, there has been a lot of misinformation about FMPA, so I hope this report ends that. All FMPA has ever tried to do is to faithfully administer the contracts for our members, their customers and our bondholders. FMPA will provide written comments to the Auditor General’s preliminary report within 30 days, as their process provides.”

Conrad’s and Guarriello’s statements were posted on the FMPA’s website.

Though numerous concerns are raised, the Auditor General’s report is absent any suggestion the FMPA is insolvent, as some utility activists have claimed, or that the agency’s leaders and staff may be guilty of “pocketing millions,” as State Rep. Mayfield intimated in a letter she sent to newspaper editors across the state. Also absent from the Auditor General’s report is any finding that FMPA leaders are guilty of malfeasance, another accusation made by some of Vero Beach’s more passionate utility activists.

Among the preliminary findings in the audit is a concern about the FMPA’s hedging activities. According the the Auditor General’s report, the FMPA lost $247.6 million in hedging related activities since 2008. The report found FMPA’s hedging activities inconsistent with industry practices used by eight comparable joint action agencies that use fuel hedging derivatives.

“Given the volatility in fuel prices, hedging using derivatives, such as commodities futures contracts, is a common industry practice. The usage of interest rate swaps to hedge interest rate volatility on variable rate debt is also a common industry practice. However, as indicated in finding Nos. 1 through 3, the FMPA’s risk tolerance for usage of derivative hedging instruments was higher than the industry norm.”

In its analysis of the FMPA interest rate swaps for the proposed Taylor County coal plant that was never built, the Auditor General’s preliminary report found that the FMPA’s issuing of variable rate bonds with corresponding fixed interest rate swaps without a corresponding bond issue amounted to “risk-taking in excess of industry practice.”

Specific to the FMPA’s Taylor Swaps, the Auditor General recommended, “The FMPA should refrain from employing interest rate swaps in the future without concurrently issuing debt to bring its interest rate hedging practices more in line with industry standard risk tolerance. Further, such activities should not be undertaken before required approvals for projects are obtained from regulatory bodies. In addition, the Executive Committee should consider, without regard to prior unrealized losses incurred, developing and executing an exit strategy for the Taylor swaps that removes the ongoing risk to the ARP members.”

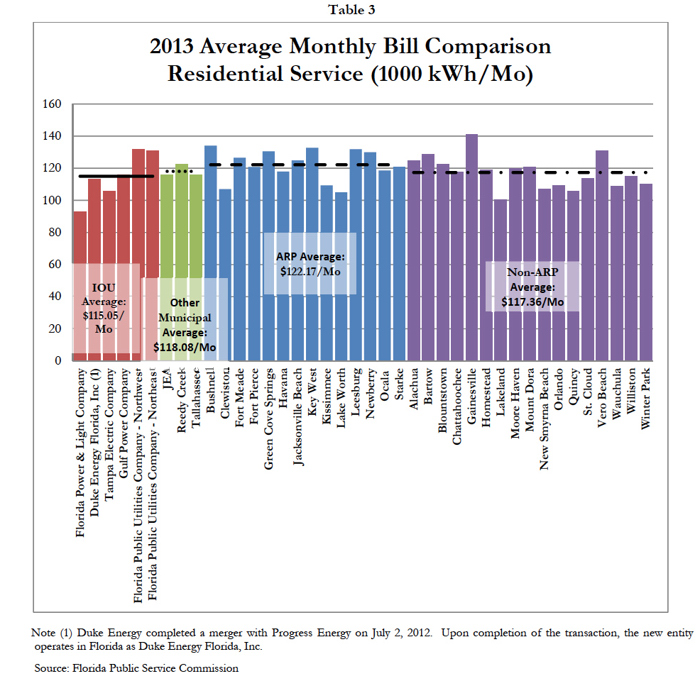

Based on 2013 data, the report compared rates for FMPA’s 14 All Requirement’s Project members, its 17 members who are not participants in the ARP, three non-FMPA municipal utilities and the state’s six investor owned utilities. FMPA members are clearly paying higher rates, though the Auditor General outlined a number of outside factors affecting rates. ”

“There are multiple factors that impact FMPA ARP members’ residential rates, some of which are not attributable to FMPA, including: 1. Several ARP members also participate in non-ARP projects. Consequently, the ARP member receives power from multiple sources at differing wholesale rates, which are factored into customer billings. 2. ARP members add additional costs, such as electrical service costs associated with delivery of power, to customer billings. 3. According to Moody’s Investors Service, ‘Many FMPA member electric utilities have sizable transfers of electric fund revenues to their municipal General Funds which can sometimes contribute to above average retail rates for some members.'”

Rates, though, are a moving target. For example, Vero Electric’s rates in Nov. 2014 were down 5.3 percent from the previous year. Over the same period, Florida Power & Light’s rates rose 7.2 percent for 1000 kWh of residential use, while rates Duke Energy, another investor owned utility, rose 8.4 percent.

The report added, “Insofar as the FMPA must recover all costs of providing power to members through billings, decisions as to the level of spending and the nature of specific activities undertaken, such as hedging, investment, and debt issuance activities, by the FMPA have an impact on the amounts charged to FMPA members. We have disclosed several FMPA activities or practices in this report that may have contributed to higher costs billed to FMPA members.”

Among its other finding, the report faulted the FMPA for paying mileage reimbursements to employees who also receive vehicle allowances. “…it is not apparent why employees receiving vehicle allowances to compensate them for business use of their personal vehicles also receive full or partial mileage reimbursement…”

Particularly relevant to Vero Beach, which is to exit the FMPA’s All Requirements Project in late 2016, the report found that only one of eight joint action agencies with power supply projects allow members to exit when there is still debt outstanding. “Based on the results of the review, the FMPA’s termination and exit notice provisions are not consistent with common JAA practice because JAA power supply contracts normally do not allow members to exit the contract while any project debt is outstanding. As indicated above, only one other JAA allowed a member to exit while project debt was still outstanding, and the contract required the withdrawing member to pay its share of debt service, which is consistent with the FMPA contract provisions.”

However, though the FMPA’s exit provisions appear to be less restrictive than other joint action agencies, the Auditor General recommended, “the FMPA should consider amending the power supply project contracts to clarify how withdrawal payments are to be calculate,” and in other ways clarify the method for calculating a member’s cost to withdraw from the ARP.

Finally, the report recommended the FMPA strengthen its disaster recovery plan by establishing an alternate data processing and IT site outside the Orlando area.

If Mrs Mayfield has any knowledge of legal wrong doing she should bring those charges to the proper law enforcement agency. Let her name names and stand behind those words to the proper agency.